A Practical Guide to Understanding Merchant Account Fees and How They Work Payment Depot

Merchant accounts form the backbone of electronic payment processing, allowing businesses to accept credit and debit card payments securely and efficiently. By understanding how merchant accounts work, the associated fees, the different types available, and the process of obtaining one, businesses can enhance their financial operations and.

What is a Merchant Account? Dharma Merchant Services

The Best Merchant Account Services Providers For Small Business Your small business needs a merchant account to process credit card payments. Read on to discover our top picks for merchant account service providers. WRITTEN & RESEARCHED BY Jason Vissers Senior Staff Writer Jul 20, 2023 UPDATED

Payments Basics What is a Merchant and Why Do I Need a Merchant Account?

The definition of a merchant account is: a type of bank account for businesses, looking to accept cashless payments.² Typically, businesses open a merchant account to receive credit and debit card payments.

What is a Merchant Account and How to Open One CoinPayments

A merchant account is a business or commercial bank account that allows companies to accept and process credit cards, debit cards and other types of electronic payments. The aim is to help.

What is a Merchant Account? Everything You Need to Know

A merchant account is a type of business bank account that allows a business to accept and process electronic payment card transactions. Merchant accounts require a business to partner with.

What is a Merchant Account?

A merchant account is a specialized type of business bank account that allows companies to accept and process electronic payment card transactions. This guide answers " what is a merchant account " and provides an understanding of how you can use merchant accounts to make better decisions for your business. Recommended: Moonlight Payments.

Reasons to use a merchant account manage their business effectively

A merchant account is a bank account that is specifically used for accepting customer payments, usually by credit card, debit card, or other electronic transfer. It's not a standard business bank account. A merchant account holds on to funds before they're transferred to the merchant's primary business bank account. Do I need a merchant account?

LongTerm Management Of Your Merchant Account

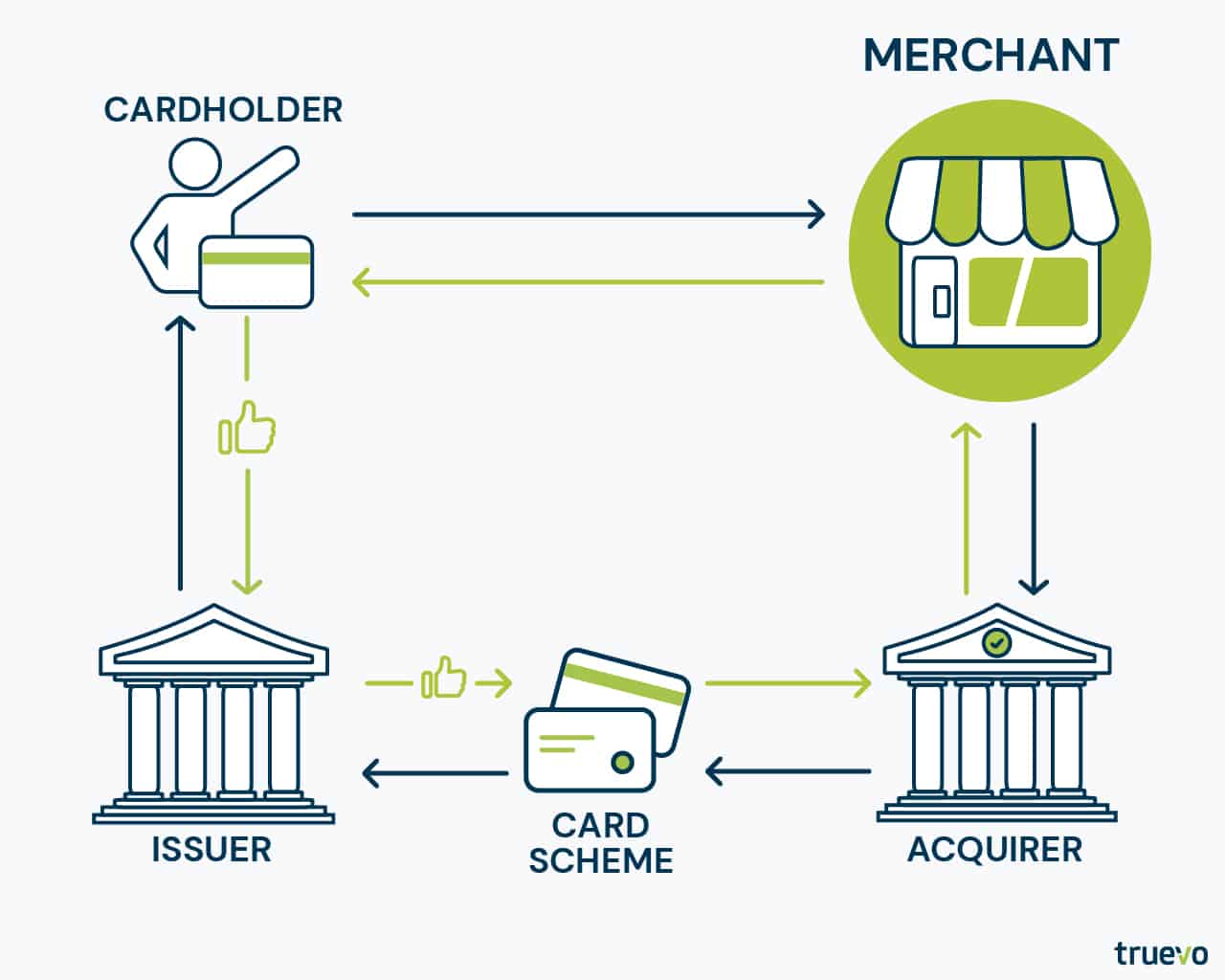

A merchant account is a bank account that holds funds from credit card sales, while a payment processor is the system that manages the transfer of fund details between the merchant, the networks, and the card issuers, often through a payment gateway for electronic payments.

Difference Between Merchant Account and Payment Gateway ambrasenatore

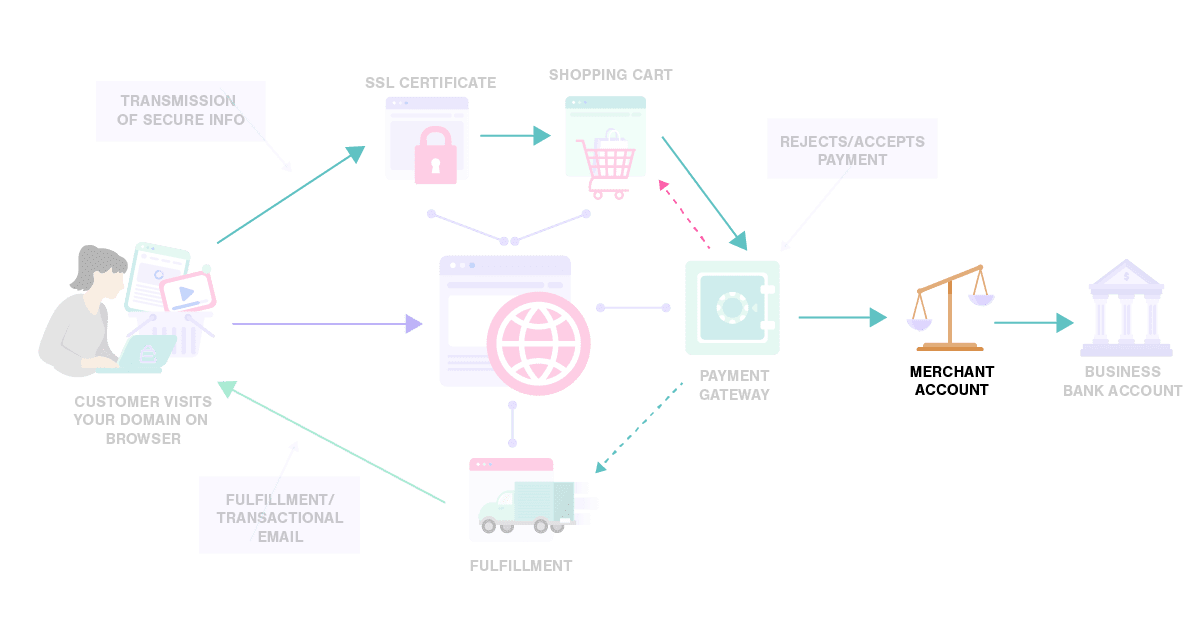

A merchant account is simply a bank account where funds from your processed credit and debit card transactions are deposited until they can be transferred to your regular business bank account. A merchant account is an essential tool for credit card processing online, in-store, and even on the go.

Best Merchant Account Services and Rates in Australia 2023

Email Facebook Twitter. A merchant account allows businesses to receive funds from their customers in various ways, including electronic payment card transactions. It serves as the intermediary between the customer's and business's bank accounts and lets companies receive money immediately instead of waiting for the buyer to pay their card.

What Is a Merchant Account and How Do You Get One?

A merchant account is usually a third-party bank account that facilitates credit or debit card payments from customers to a business by holding card payments and then depositing them into a.

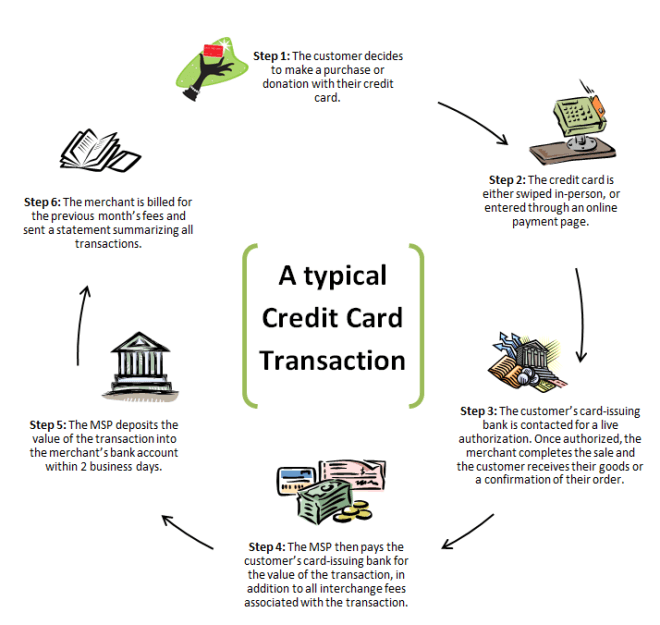

Merchant Account Transaction Flow

A merchant account is a particular type of bank account that business owners must establish in order to accept payments. Currently, consumers' most preferred payment methods are credit and debit cards. In 2021, consumers paid for 70 percent of their purchases with a credit or debit card. [1] Statista.

Payment Gateway vs Merchant Account Updated Guide

A merchant account works by charging you a small fee in exchange for quick access to the funds from your business's credit card transactions. They basically front you money for electronic transactions. Think about it: when a customer uses their credit card, they're not paying cash but instead creating a promise to pay within a period of time.

How to Read a Merchant Statement & Why It’s Important

A merchant account is a type of bank account that allows your business to accept debit and credit card payments from customers. Your merchant account will front your business the funds—minus fees—from the credit card transactions you accept, before your customers pay off their card issuers.

Payment Gateway vs Merchant Account What's the Difference?

Merchant accounts are a must for any business that wants to accept credit card payments. Here's what a merchant account is, how they work, and how to get one.

What is a Merchant Account Rates, Pricing, Terminals and how it works YouTube

A merchant account is a special type of bank account that makes it possible for businesses to accept multiple payment types. Generally, it allows your business to accept debit card and credit card payments online, in-person, and over the phone.